|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

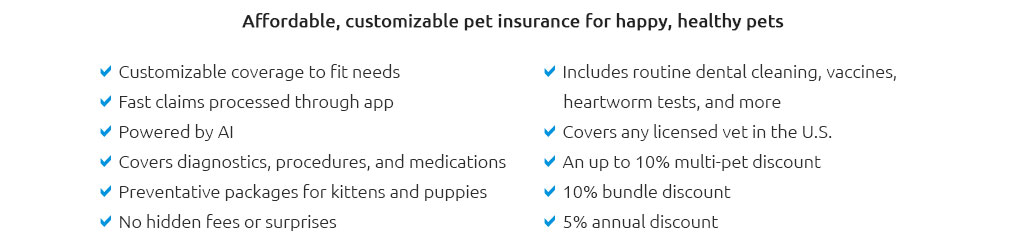

Exploring the Best Pet Insurance for Cats: A Comprehensive GuideWhen it comes to ensuring the well-being of our feline companions, pet insurance emerges as a pivotal consideration for many cat owners. As cats are prone to a variety of health issues, from minor ailments to more serious conditions, having a reliable insurance plan can be a lifesaver both literally and financially. Choosing the best pet insurance for your cat involves understanding a complex array of factors, each of which can significantly impact the quality of care your pet receives and the cost incurred by you. Firstly, it's essential to evaluate the coverage options that different pet insurance providers offer. A robust insurance policy should cover a wide range of potential health issues, including accidents, illnesses, hereditary conditions, and even preventive care such as vaccinations and dental cleanings. Some policies might also offer coverage for alternative therapies, behavioral treatments, or even end-of-life care, which can be invaluable in managing the full spectrum of your cat's health needs. One of the best approaches to selecting the right insurance is to create a comparison list of the top insurers. Among the most frequently recommended are Healthy Paws, Embrace, and Nationwide. Each of these companies brings something unique to the table. For instance, Healthy Paws is often praised for its comprehensive accident and illness coverage with no lifetime caps on payouts. Meanwhile, Embrace stands out with its wellness rewards program that reimburses for routine care, a feature that may appeal to proactive pet owners. Nationwide, on the other hand, offers one of the most extensive coverage options, including exotic pets and a wellness plan that covers vaccinations, flea control, and more. In addition to coverage, cost is a significant consideration. Premiums can vary widely depending on factors such as the age and breed of your cat, your geographical location, and the specific coverage options you select. It is wise to obtain quotes from several insurers and consider not only the monthly premium but also the deductible, reimbursement level, and any annual or per-incident limits. While a lower premium might seem attractive at first glance, higher out-of-pocket expenses can quickly offset these savings if your pet requires extensive medical care. Customer service and claim processing efficiency are other critical aspects to consider. The best pet insurance providers are those that offer responsive customer support and a straightforward, hassle-free claims process. Checking reviews and testimonials from current or past policyholders can provide valuable insights into how well a company meets these criteria. An insurance provider that is easy to contact and resolves claims promptly will make your experience as a pet owner much smoother. Ultimately, the decision of which pet insurance to choose should align with your financial situation, your cat's specific health needs, and your peace of mind. Investing in pet insurance is not merely about covering potential veterinary bills; it’s about securing the best possible care for your beloved feline friend without the burden of financial strain. In a world where veterinary advancements are enabling longer, healthier lives for our pets, having a comprehensive insurance plan means you can make decisions based on what’s best for your cat rather than what you can afford at the moment. In conclusion, while the market for pet insurance is vast and varied, taking the time to research and compare different options will undoubtedly pay dividends in ensuring your cat's health and well-being. Whether you’re a new cat owner or have shared your life with felines for many years, finding the best insurance plan is a step toward giving your pet the happy, healthy life they deserve. https://www.cbsnews.com/news/want-the-best-pet-insurance-for-your-cat-do-this-now/

It's worth noting that pet insurance for cats tends to be cheaper than for dogs. According to the North American Pet Health Insurance ... https://www.youtube.com/watch?v=cIrrnFXR8lY

It's great if you have one or two young cats with no pre-existing conditions. Otherwise, those of us who have elderly, chronically ill animals or who are ... https://www.youtube.com/watch?v=jd897tJvBQI&pp=ygUMI3BldGZhbWVwbGFu

19K views - 15:38 - Go to channel - Best Pet Insurance for Cats (Our Top 6 Recommendations). Cats52K views - 38:02 - Go to channel - Cat Expert ...

|